```html

Digital transformation is much more than a buzzword; it’s everywhere. From home automation to contactless payments with BNPL (buy now, pay later) services, consumers are experiencing rapid digital evolution.

Significant challenges were born from the COVID-19 pandemic. But digital transformation in banking and financial organisations has enabled them to grow, ensure business continuity, and help Australians (in both business and personal settings) to stay connected.

Banks, credit unions, and finance organisations have largely begun their digital transformation journeys, but many are still in the initial stages. Cornerstone Advisors reports that 47% of organisations surveyed have already deployed cloud computing, with 26% planning to invest or implement in 2022. The same report shows by the end of 2022, just 11% of banks and 4% of credit unions will not have launched a digital transformation strategy.

Massive consumer shifts toward digital behaviours have forced companies to advance technologically and, in turn, realise greater benefit for their organisations.

As a result of digital initiatives implemented, many financial institutions have increased agility, responded more quickly to market changes, and adapted to consumer needs. And while there have been plenty of challenges, CFOs are seeing a bright future ahead.

As shown in Deloitte Australia’s CFO Sentiment Report, 81% of CFOs are feeling optimistic, or highly optimistic, about their company's financial prospects in 2022. Additionally, the 23% response of ‘highly optimistic’ is the highest since this survey question was first asked in 2017.

However, there is still a long roadmap ahead. Financial services companies are progressing at different paces, with some cementing their competitive advantage much faster than others.

Digital demands drive competitive advantage

More than half of millennials are happy to switch to (or already have) a digital-only bank.

According to a deVere Group global poll of clients born between 1980 and 1996, an incredible 59% are only using digital banking services or were planning to make the switch within the year.

Convenience and speed of digital interactions are now critical factors for consumers when choosing the financial services companies to fit their needs.

deVere Group CEO and founder Nigel Green explains, “Mobile-first millennials expect easy, immediate access and control of their finances in the palm of their hand. They demand to be able to transfer money and pay bills in one tap or swipe. They want to be able to review their spending habits, be offered guidance, and have real-time access.

“Traditional banks have a long way to go to catch-up with tech-driven challenger banks and fintech firms, which are intrinsically much greener and are leading the charge to a paperless future.”

It’s clear that financial organisations must invest in digital capabilities to meet ever-increasing consumer demands. Only those who anticipate and exceed customer expectations will be able to show a compelling advantage over their competitors.

61% of Gen Z, Gen X, and millennials are most likely to switch to fully digital banking for services such as 24X7 accessibility, remote banking digital experiences in place of crowded branch visits, and ease of banking.

Business technology to improve the customer experience

Traditional banks and other financial institutions, including insurance, credit providers, and payment services, are at a digital crossroads. Consumers have made it clear they want their financial service providers to adapt.

A study by Mint shows that 61% of Gen Z, Gen X, and millennials are most likely to switch to fully digital banking for services such as 24X7 accessibility, remote banking digital experiences in place of crowded branch visits, and ease of banking. This data shows one example within the financial services industry of fewer customers wanting in-person services while expecting greater ease of digital services.

It’s now critical to ensure outstanding customer experiences across all digital touchpoints. In fact, A Qualtrics survey found that a staggering 89% of companies leading with customer experience performed financially better than their competitors. To gain a clear competitive advantage, financial services firms must implement the business technology needed to deliver those experiences.

More informed, valuable customer interactions

At a time when customers are moving away from in-person services, the quality of communications is more crucial than ever. And CRM software is a core business technology that can enhance every customer interaction.

A CRM system (customer relationship management) could be described as a customer experience management platform. It enables logging, tracking, and detailed insights to be gained from all customer data - from lead to customer advocacy.

By gaining detailed information about customer needs and pain points, your business can understand (and anticipate) your customers’ expectations. As a result, every customer interaction contains more value and becomes an opportunity to build trust.

CRM software brings together data across multiple touchpoints such as marketing campaigns, sales data, NPS scoring, customer service feedback, and the list goes on. Everyone in your organisation can see when a customer clicks on a marketing email, talks to a sales rep about additional services, or provides feedback. This data gives every department a holistic view of each customer and helps your teams identify when to reach out.

89% of companies leading with customer experience performed financially better than their competitors. To gain a clear competitive advantage, financial services firms must implement the business technology needed to deliver those experiences.

The real magic of a CRM system

CRM software is about more than bringing data (and departments) together. It’s about enabling your financial services firm with better interactions that drive outstanding customer experiences.

Take a typical example of Tom who is moving house next month. He’s been calling other organisations with much trouble getting hold of the right departments. He now calls your organisation (a financial credit provider, for this example). He explains to the customer service rep, Janet, that he needs help and is a bit flustered after some not-so-great calls with other companies.

After verifying Tom’s identity, Janet pulls up his complete history and interactions with your business. She updates Tom’s address details straight away. She notices that Tom doesn’t have any other products with the business, such as home insurance. But Janet knows that an upsell attempt probably isn’t appropriate right now. She lets Tom know his details have been updated and thanks him for calling.

Is this a missed upsell opportunity?

Absolutely not. In fact, this is where the real magic of a CRM system happens. After the call, Janet creates a note for marketing to send a specific email campaign to Tom the following day. The email wishes Tom luck with moving house, confirms his new updated address (giving him confidence that his details are now correct), and gives Tom direct contact details if he needs help with any other services.

Janet also creates a note for a sales rep to check in with Tom in another few days. Janet notes that Tom was frustrated at the time because of the difficulties he had in contacting other companies.

Sam, the sales rep, gives Tom a call. Sam begins with a relaxed conversation about how Tom’s going with his moving plan. Tom’s in a much better mood now, and thanks Sam for asking. Next, Sam asks if Tom saw the email confirming the new address details with your company’s direct contact numbers. Tom’s happy to say he did and mentions he appreciated the personal touch. With a more informed call that helps build rapport, it’s now the perfect time for Sam to ask whether Tom has sorted his home insurance policy.

After delivering another positive customer experience (and selling a new insurance policy), Sam adds a CRM note for Janet. He asks her to schedule an NPS (net promoter score) survey to go out to Tom in another couple of days. Given the string of positive experiences Tom’s just had, what do you think the rating will be?

When your organisation prioritises CRM software as part of its digital transformation plan, you can make smart process improvements that keep sales, marketing, and customer service more closely aligned. And the end result? More informed, valuable customer interactions that create memorable customer experiences.

See our complete guide, Why CRM Software is Vital to Your Revenue Generation Strategy, for more information.

74% of business decision-makers in the financial services sector say that the COVID-19 pandemic has exposed more gaps in their business operations and systems than they initially expected.

The essential ingredient for success

Digital transformation is much more than a buzzword; it’s now an essential ingredient for success.

Financial services firms have seen rapid consumer behaviour shifts. They must keep up with the pace of digital evolution or risk losing customers to competitors.

According to a Pegasystems Inc study, 74% of business decision-makers in the financial services sector say that the COVID-19 pandemic has exposed more gaps in their business operations and systems than they initially expected. 71% say the experience has made them accelerate digital transformation plans, with 62% saying it will increase the priority level of digital transformation within their organisation.

To gain a clear competitive advantage, organisations must deliver digital change that supports evolving customer demands. However, many organisations still find themselves stuck in traditional ways of doing business. While digital services such as mobile apps and live chat are becoming more common, the core digital infrastructure is often outdated.

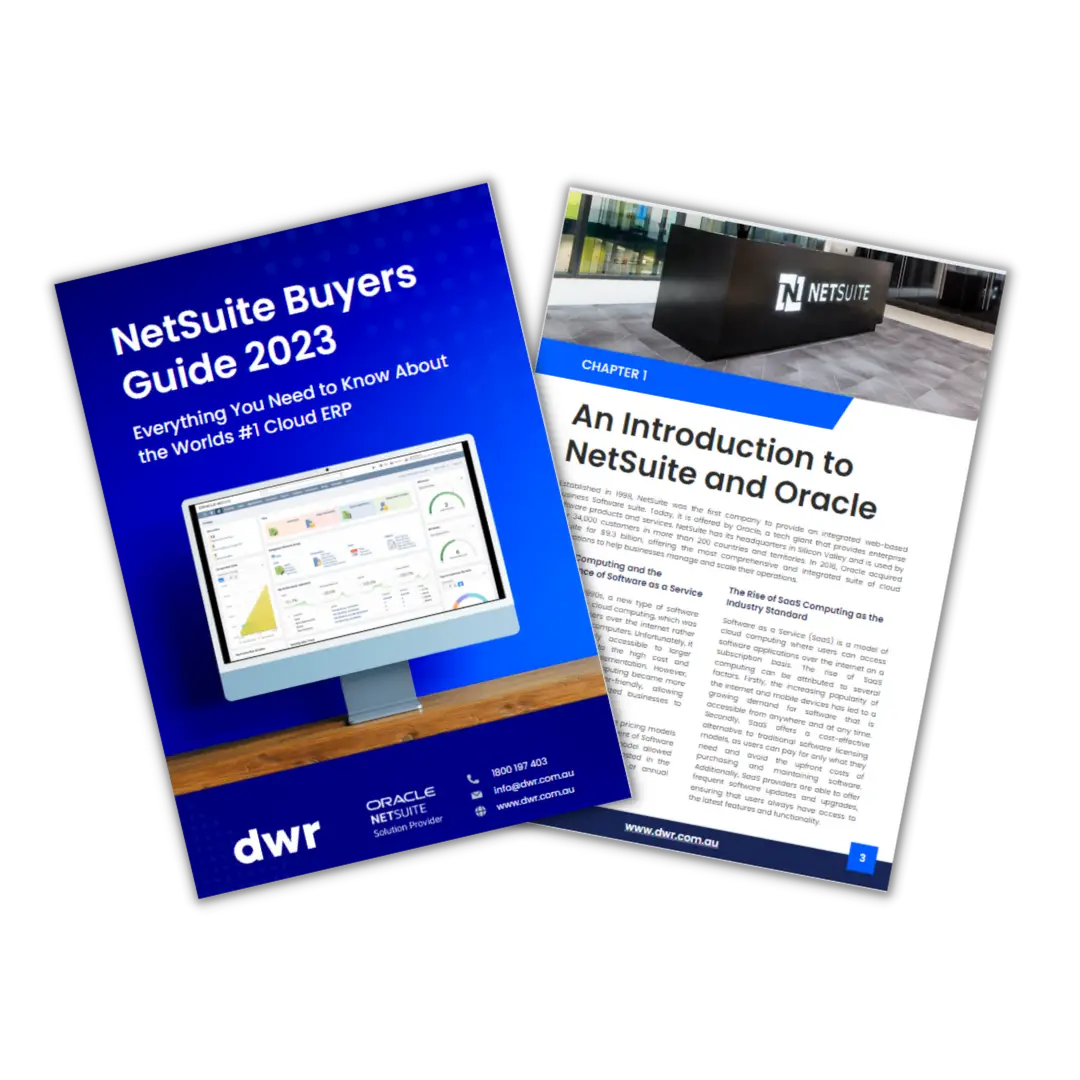

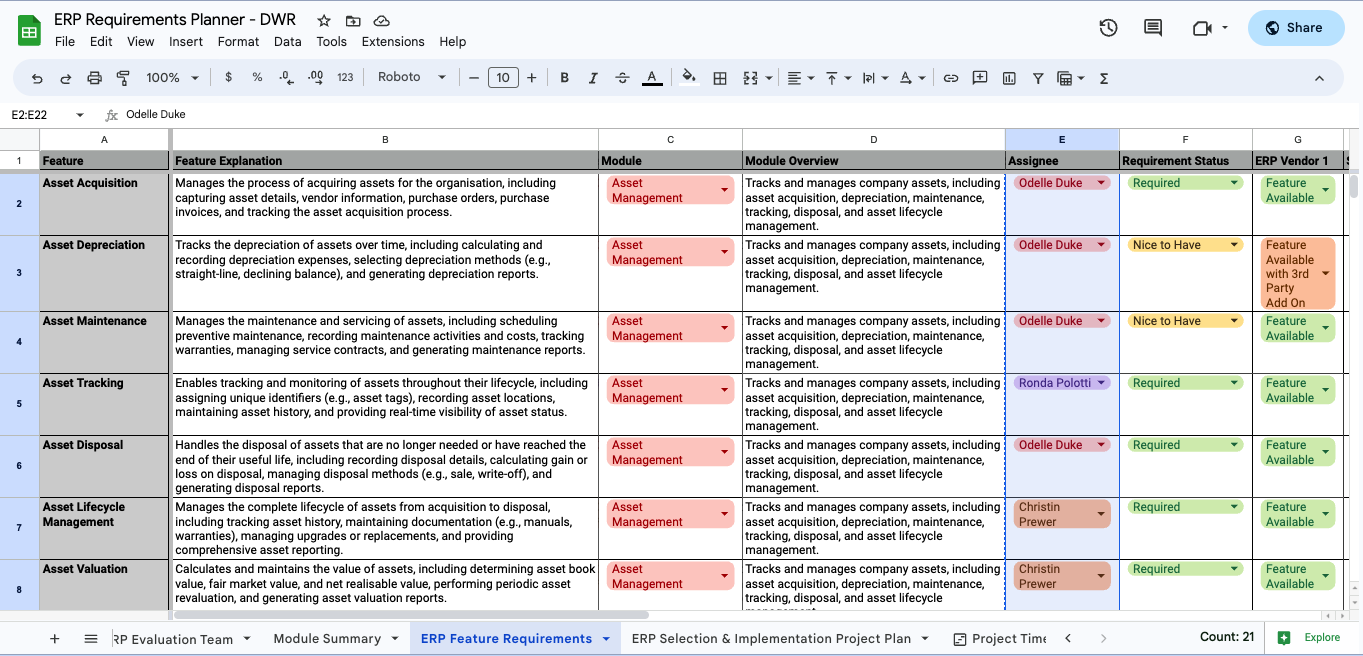

A large number of financial institutions have already implemented cloud ERP and CRM solutions as the building blocks of their transformation journeys. ERP and CRM systems like NetSuite also have native API functionality to connect with any other digital system. This approach delivers a robust core financial and operational framework while creating an integrated solution to drive omnichannel customer experiences.

Business technology is undeniably the foundation for delivering outstanding digital experiences that turn your organisation’s customers into life-long advocates. The only question remaining is how far along your transformation journey you’d like to be in 2022.To learn more about the solutions available, reserve your no-obligation digital discovery session with a cloud technology expert.

Why CRM Software Is Vital to Your Revenue Generation Strategy

Get your in-depth CRM business guide with detail about:

✔️ The 7 signs your business needs a CRM now.

✔️ Managing leads, pipeline, and forecasting more effectively.

✔️ How sales teams can improve the customer experience and boost revenue.

And a lot more to uncover. Download your in-depth CRM guide now.

```

.svg)

.avif)