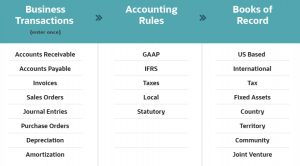

The NetSuite multi-book accounting module allows businesses to maintain and manage multiple sets of accounting books within a single system. This can be especially useful for companies that operate in multiple countries or have multiple subsidiaries, as it allows them to maintain separate books for each entity while still having all of the information stored in a centralised location.

With multi-book accounting, businesses are able to:

Gain Insights into Global Finances

By having all financial data stored in one place, NetSuite customers can gain a better understanding of their international finances by running reports and analysing performance across books.

Increase Visibility and Accuracy

Multi-book accounting helps to reduce the possibility of errors by allowing users to view consolidated balance sheets and other reports across books. It also gives them access to real-time financial data so they can make more informed decisions without relying on outdated information.

Improve Local Compliance

Companies with multiple subsidiaries may be required to comply with different regulatory requirements, depending on the country in which they operate. By using NetSuite’s multi-book accounting feature, customers can ensure that their financials are in compliance with each and every jurisdiction.

Reduce Costs

Multi-book accounting helps to reduce manual data entry and other time-consuming tasks as all information is stored in one place. This reduces the need for costly accounting audits, as well as saving businesses money on IT infrastructure and software licences.

Comply With Global Accounting Regulations

One of the biggest benefits of using NetSuite’s multi-book accounting feature is that it can help businesses to comply with local accounting regulations. Each country and region has its own unique set of rules and regulations when it comes to accounting, and failing to comply with these rules can result in penalties and other costly consequences. By using NetSuite’s multi-book accounting, businesses can easily maintain separate books for each entity, ensuring that they are in compliance with the local regulations in each area.

Streamline Accounting Processes

Another benefit of using NetSuite’s multi-book accounting is that it can help businesses to streamline their accounting processes. When a business’s accounting information is stored in a single system, it becomes much easier to access and manage. This can save time and reduce the risk of errors, as all of the necessary information is readily available in one place. This is especially important for businesses that have complex networks of entities.

Gain Better Access to Information

Additionally, NetSuite’s multi-book accounting allows businesses to easily track and manage their financial data, providing a clear picture of their financial health and helping them to make informed business decisions. Multi-book accounting helps to provide a more comprehensive view of the business, allowing managers to quickly and easily access the information they need.

NetSuite Multi-Book Features

NetSuite's Multi-book accounting features offer users all the tools they need to manage multiple sets of accounting books. It allows users to easily create, view and update separate books for each entity, including balance sheets, profit and loss statements, general ledgers and more. Additionally, NetSuite's multi-book feature provides users with real-time financial data so they can make informed decisions quickly and accurately.

Multi-Book also offers a Consolidations tool that allows companies to analyse performance across multiple entities in one place. Overall, using NetSuite’s multi-book accounting feature can help businesses save time and money while ensuring compliance with local regulations. The ability to access real-time financial data also makes it easier for businesses to gain insights into their global finances and make better decisions. With the power of NetSuite’s multi-book accounting, businesses can streamline their bookkeeping processes and save on costs while gaining access to valuable insights into their global finances.

Some stand-out features of NetSuite Multi-book accounting include:

Rule-Based Automation Engine

NetSuite Multi-Book is an automated accounting system that operates using a rule-driven engine, designed to streamline financial processes and reduce errors in reporting. By managing unique sets of books per accounting standard, the system eliminates the need for manual data entry replication and reduces the risk of error-prone manual adjustments in your accounting and reporting processes.

With NetSuite Multi-Book, businesses can report financial results based on multiple accounting standards concurrently, providing a comprehensive view of their financial situation. The system optimises the financial close process by posting concurrent transactions to all books as business transactions occur, rather than waiting until the end of the period to replicate data entry and post adjustments. This allows for real-time visibility and accurate flash reports for any book, anytime.

Additionally, NetSuite Multi-Book provides ongoing compliance by allowing for necessary customisations in your accounting processes, ensuring that you remain up-to-date with new accounting rules, tax laws, and other changes. The system also improves communication with stakeholders by providing "before" and "after" reports, which show the impact of any changes made to the financials.

NetSuite Multi-Book also has the capability to assign fixed assets to multiple books with different currencies and/or depreciation methods, and manage financials across the company with subsidiary-book relationship mapping. With pre-built mapping capabilities between your primary and secondary charts of accounts, the NetSuite Multi-Book engine can record all book-specific activity based on a single business transaction for the general ledger, revenue recognition, expense amortisation, depreciation, P&L allocations and more.

Foreign Currency Management

Foreign Currency Management is a key aspect of financial management for businesses that operate in multiple countries and deal with transactions in different currencies. This feature enables businesses to support transactions and financial reporting in multiple currencies, which is critical for managing global accounts more effectively, while still adhering to local accounting regulations.

When a business operates in multiple countries or deals with foreign suppliers, they must transact in different currencies. Foreign Currency Management allows businesses to manage these transactions more efficiently by supporting the conversion of foreign currencies into the company's base currency. This ensures that financial data is accurately recorded and reported across different currencies, without the need for manual calculations.

In addition, this feature provides a comprehensive view of the company's financial performance in different currencies. By allowing businesses to report their financial data in multiple currencies, it enables businesses to better understand their global financial situation and make informed decisions. This is particularly important for businesses that operate in multiple countries, as it allows them to track the performance of each country individually and make comparisons across different regions.

Foreign Currency Management also ensures compliance with local accounting regulations in each country. Different countries have different accounting standards, and it is essential that businesses comply with these regulations. This feature enables businesses to comply with the relevant regulations for each country, while still managing their financial data effectively.

Journal Entry Consolidation

Journal Entry Consolidation is an important feature of Multi-Book that allows businesses to combine individual books into larger sets of books for consolidated financial reporting. This enables businesses to get a more accurate picture of their global financial health, and ensures that all financial information is accurately recorded and reported.

When a business operates in multiple countries or regions, it may have separate books for each region, each with its own unique accounting standards and reporting requirements. Journal Entry Consolidation allows businesses to consolidate these individual books into a larger set of books, which can be used for financial reporting across the entire organisation.

This consolidation process involves combining the individual journal entries from each book and mapping them to the relevant accounts in the consolidated set of books. Once this is done, the financial data can be reported in a consistent format across the entire organisation, providing a more accurate picture of the company's overall financial health.

By using Journal Entry Consolidation, businesses can also eliminate any potential errors that may occur when consolidating financial data manually. This feature ensures that all financial data is accurately recorded and consolidated, reducing the risk of errors and inconsistencies in the financial reporting process.

Multi-Book Financial Reports

Multi-Book Financial Reports enable businesses to generate consolidated financial reports for multiple sets of books. This feature allows businesses to better understand and manage their finances on a global scale, by providing a comprehensive view of their financial performance across different regions and accounting standards.

Multi-Book Financial Reports provides a complete view of the company's financial performance, making it easier to identify trends, areas for improvement, and potential risks. This is particularly important for businesses that operate in multiple countries or regions, as it enables them to get a more accurate picture of their global financial health.

The reports generated through Multi-Book Financial Reports can be customised to meet the specific reporting requirements of each business. This allows businesses to tailor the reports to the needs of their stakeholders, providing them with the information they need to make informed decisions. Multi-Book Financial Reports also provide businesses with the ability to drill down into the financial data to identify specific trends or issues. This feature allows businesses to identify areas where they can improve their financial performance, reduce costs, or increase revenue. It also enables businesses to identify potential risks, such as currency fluctuations, and take steps to mitigate them.

Automated workflow to ensure accuracy and efficiency

The automated workflow allows businesses to create custom workflows for reviewing and approving journal entries. This enables them to set up a process that meets their specific requirements and ensures that all journal entries are reviewed and approved by the appropriate individuals. The workflows can be customised to include multiple steps, such as initial review, manager approval, and final sign-off, ensuring that all entries are reviewed thoroughly before they are posted.

The automated workflow is designed to be intuitive and easy to use, making it simple for businesses to review and approve journal entries quickly and efficiently. The system provides notifications when new entries are ready for review, ensuring that the approval process is not delayed. This feature saves time, as it eliminates the need for manual review and approval of journal entries, which can be time-consuming and prone to errors. Automated Workflow also ensures accuracy, as it eliminates the risk of errors that may occur during manual review and approval of journal entries. This feature provides a consistent and reliable process for reviewing and approving journal entries, which reduces the risk of errors and inconsistencies in financial reporting.

Ability to track inter-company transactions

The ability to track inter-company transactions is a crucial feature of Multi-Book that enables businesses to track and manage financial transactions between different entities within the organisation. Inter-company transactions refer to financial transactions that occur between two or more entities within the same organisation.

By tracking inter-company transactions in a single system, Multi-Book makes it easier for businesses to monitor the flow of funds between various entities. This feature provides businesses with a comprehensive view of their financial transactions, enabling them to manage their finances more effectively. This is particularly important for businesses that operate in multiple countries or regions, as it allows them to track transactions across different regions and currencies.

Tracking inter-company transactions also ensures that these transactions are being accurately reported and managed. This feature allows businesses to ensure that all inter-company transactions are being recorded accurately and in accordance with local accounting regulations. It also ensures that any discrepancies or errors in inter-company transactions are identified and addressed promptly, reducing the risk of financial losses.

Multi-Book provides businesses with the flexibility to customise the tracking of inter-company transactions to meet their specific needs. This can include customising the rules for the automatic recording of inter-company transactions, setting up different approval workflows for different types of transactions, and creating custom reports to monitor inter-company transactions.

Real-time visibility into global financial data

Real-time visibility into global financial data is a critical feature of Multi-Book that enables businesses to get a comprehensive view of their financial performance across multiple entities in real-time. This feature allows businesses to make informed decisions quickly and accurately, based on up-to-date financial information.

With Multi-Book, businesses can consolidate their financial data from multiple sets of books into a single system, providing real-time visibility into their global financial data. This feature allows businesses to view financial information for multiple entities in one place, making it easier to get a better understanding of their business's financial health. This is particularly important for businesses that operate in multiple countries or regions, as it provides a comprehensive view of their financial performance across different regions and accounting standards.

Real-time visibility into global financial data enables businesses to identify trends and patterns in their financial data as they occur. This allows businesses to make informed decisions quickly, based on up-to-date financial information. It also enables businesses to identify potential issues or risks in their financial data, such as unexpected expenses or fluctuations in currency exchange rates, and take corrective action where necessary.

In Summary

Overall, NetSuite multi-book accounting offers a number of benefits for businesses that are looking to streamline their accounting processes and adhere to global regulations. By managing multiple sets of books in a single system, businesses can save time and effort while also ensuring that they remain compliant with local laws. Additionally, multi-book accounting allows for better access to financial data, providing a more comprehensive view of the business and helping managers to make informed decisions.

.svg)

.avif)