Oracle NetSuite has just announced SuiteBanking - the first unified suite that embeds fintech into a cloud ERP system. SuiteBanking helps customers improve forecasting and make more strategic cash decisions by automating key financial processes and providing full visibility into cash flow.SuiteBanking brings together automated accounts payable (AP) and accounts receivable (AR) processes, making it fast and easy to pay bills, send invoices, and get paid - all from within the one core ERP platform, NetSuite.

“Growing organisations cannot afford to have teams of people entering data, dealing with banks, monitoring transactions from multiple systems, and manually processing vendor payments. The time saved from automating these processes could be spent on strategic projects that help drive further growth for the organisation,” said Evan Goldberg, EVP, Oracle NetSuite. “SuiteBanking is the first step in bringing the worlds of ERP and fintech together. It will help our customers automate all of these processes in one single suite and increase visibility and control so they can maintain healthy cash flow as they grow.”The key to realising significant time savings for finance teams is in removing the need to collect and normalise data from other departments and applications. Teams can now save dozens of hours every month and do more with fewer resources. The enhanced automation of SuiteBanking delivers better expense control, effectiveness of accounting processes, and more detailed insights, all from the one system. Cash flow is accelerated through enhanced AP and AR processes.Leading international bank, HSBC, is the first SuiteBanking alliance partner to jump onboard with this exciting fintech innovation. Integration with banking partners will give NetSuite customers convenient access to a wide variety of financial services, including a global digital wallet and virtual payment card.

"At the core of it is AP and AR automation, accelerating productivity through efficiency, less entering of data, less dealing directly with the with the bank, less manual matching of transaction."

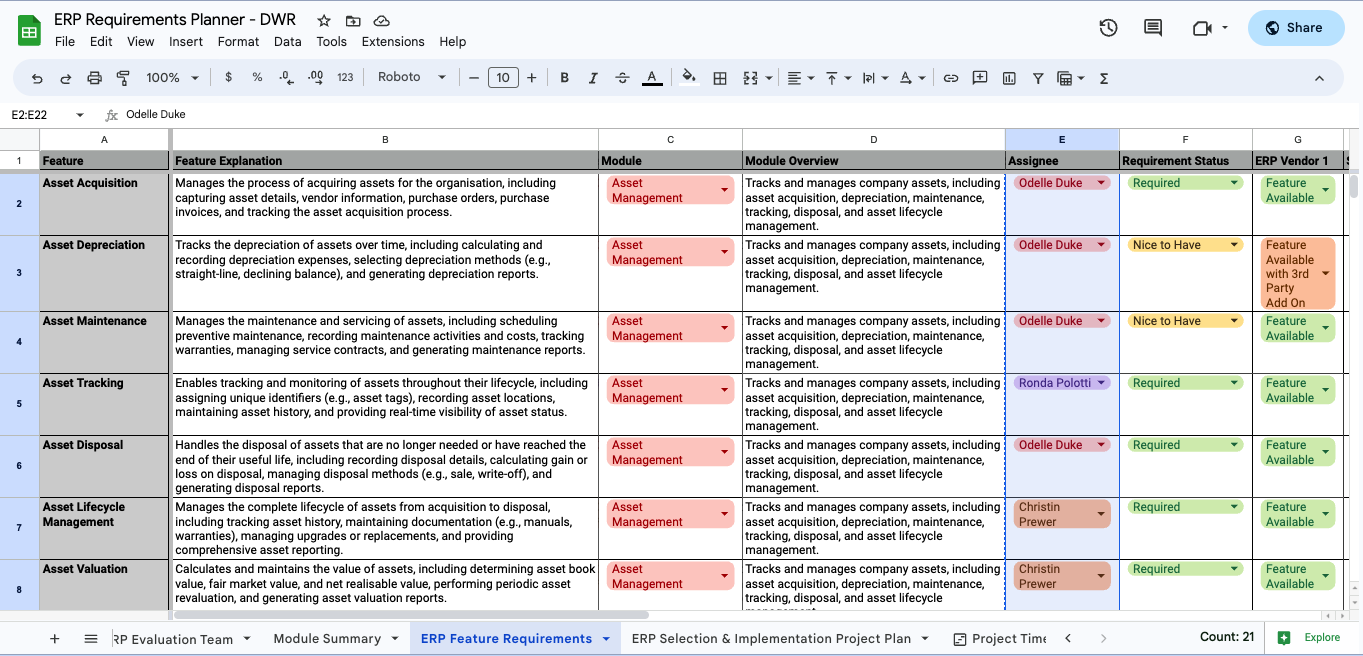

With SuiteBanking, NetSuite customers are able to improve the following cash flow processes:

- Accounts Payable: Helps customers accelerate accounts payable processes with automated invoice scanning and general ledger code assignment, three-way invoice matching, and automated outbound payments. Customers can see multiple payment options and select the preferred method for each vendor. For example, they can choose either the fastest or the least expensive option.

- Accounts Receivable: Helps customers increase on-time payments, reduce days sales outstanding, and improve the efficiency of billing staff. The new Payment Link feature makes it easier for customers to receive payment by including a “pay now” option on electronic invoices. Multiple payment methods are supported, including credit/debit card, ACH transfer, or a third-party payment provider like PayPal. In addition, customers can automate the creation and scheduling of invoices and increase collections by sending payment reminders automatically.

Goldberg also revealed, "There’s a full portal called MyAccount, which lets them manage all of their invoices and other information that resides in NetSuite, 24×7, on the web."

- Bank Reconciliation: Helps customers eliminate manual, error-prone, and time-consuming tasks and accurately match transactions with their organization’s bank account. Customers gain improved cash flow visibility through real-time insight into the status of inbound and outbound payments. In addition, customers are able to increase the accuracy of accounting data by matching and reconciling cleared transactions more often and are able to gain a better understanding of their current cash position so they know how much cash is available in their accounts at all times.

- Spend Management: Helps customers control corporate spend through better visibility and reporting capabilities. It enables customers to create approval workflows to fit their organization’s structure and customise expense policy rules to flag expenses that need a manager’s review. In addition, budget validation capabilities help managers avoid overspending by automatically comparing open purchase requests to available budget and alerting to potential budget overages prior to approval. Budget versus actuals reporting also helps managers control spending by comparing actual expenses against budgets in real time.

- Expense Management: Helps customers control costs, enforce internal policies and procedures, and improve the timeliness and accuracy of employee expense reports. Customers can pay vendors that accept credit cards directly out of NetSuite via their SuiteBanking virtual payment card, which extends payment terms and relieves cash flow. Customers can also better manage business expenses by using the virtual card to cover employee expenses or corporate credit card charges. Expenses are captured and submitted electronically and automatically flow into NetSuite, eliminating double entry and accounting errors. In addition, customers receive cash back rewards on all transactions when using the virtual card to make payments.

- International Payments: Provides customers with a global digital wallet to make and accept payments from a single account, utilizing HSBC’s global footprint and presence in more than 60 countries, instead of using country-specific payment providers that result in separate AP processes. This makes it easy for customers to make and receive international payments and removes the complexities of opening and managing multiple foreign bank accounts.

- Access to Working Capital: Helps improve cash flow by giving customers a convenient way to convert unpaid invoices into cash. NetSuite enables quick, convenient access to additional working capital with accounts receivable financing.

Learn more about amplifying your success with innovative ERP technology, implemented by an award-winning NetSuite partner.Talk to an expert at DWR and take the next step to leap ahead.

.svg)

.avif)