For most businesses, Enterprise Resource Planning (ERP) systems are the backbone of organisational operations. Yet, as these systems become more sophisticated and interconnected, they also become more vulnerable to security threats and complex compliance requirements. For CFOs, understanding and managing these risks is no longer optional, it's a critical aspect of financial stewardship and strategic leadership.

Modern Threats to System Security and Compliance

Sophisticated Cyber Threats

As ERP systems become more complex, so too do the threats they face. Modern cyberattacks are becoming increasingly sophisticated, capable of adapting to and evading traditional security measures. These threats can analyse patterns in your ERP system's defences and exploit vulnerabilities with unprecedented speed and precision. For CFOs, this means that cybersecurity can no longer be viewed as just an IT issue - it's a critical financial risk that demands our attention and investment.

Data Proliferation and the Expanding Attack Surface

The increasing granularity of data collected by modern ERP systems has led to an explosion in the volume of sensitive information being processed and stored. This data proliferation dramatically increases the 'attack surface' - the number of potential entry points for cybercriminals. Managing this expanded attack surface requires a fundamental rethinking of our approach to data governance and security.

Managing Third-Party Risk

Modern ERP systems often rely on a complex ecosystem of third-party providers and integrations. While these partnerships can provide powerful capabilities, they also introduce new risks. Each third-party integration represents a potential vulnerability, and CFOs must be vigilant in assessing and managing these risks to protect their organisation's data and reputation.

Short on time? Download this article to read later or share with a colleague.

Navigating Security and Compliance in Modern ERP Systems

Download Here!

Compliance in a Complex Regulatory Environment

Global Data Protection Regulations

The introduction of regulations like the General Data Protection Regulation (GDPR) in Europe and the Patriot Act in the United States has created a complex web of data protection requirements. Modern ERP systems, with their ability to collect and analyse vast amounts of personal data, are particularly impacted by these regulations. CFOs must ensure that their ERP systems are not just powerful, but also compliant with a patchwork of global regulations. For Australian companies operating in certain industries like Government, Defence and Medicine, this means ensuring that your data is stored securely on local servers to ensure maximum levels of control over data access.

Algorithmic Accountability and Transparency

As automated decision-making becomes more prevalent in ERP systems, particularly in areas like predictive analytics, new ethical and regulatory challenges emerge. Concepts like algorithmic bias and transparency are becoming complex compliance issues that previously had not been considered. CFOs must be prepared to demonstrate the fairness and explainability of their automated processes, not just to regulators, but also to stakeholders and customers.

Industry-Specific Compliance

Many industries face specific regulatory requirements that impact ERP systems. For instance, financial services firms in the UK must adhere to Financial Conduct Authority (FCA) regulations, while healthcare organisations need to ensure compliance with data protection laws and healthcare-specific regulations. These industry-specific requirements add layers of complexity to ERP security and compliance, demanding tailored solutions and specialised knowledge.

Emerging Solutions and Best Practices

Advanced Threat Detection Systems

Modern security solutions can analyse vast amounts of data in real time, identifying and responding to threats far more quickly than traditional systems. These advanced systems can detect anomalies that might indicate a security breach, even if the specific type of attack is previously unknown. For CFOs, investing in these enhanced security measures can provide a robust defence against evolving cyber threats.

Blockchain for Data Integrity and Audit Trails

Blockchain technology is emerging as a powerful tool for ensuring data integrity and creating immutable audit trails within ERP systems. By providing a tamper-proof record of transactions and data changes, blockchain can enhance both security and compliance efforts. CFOs should consider how blockchain might be integrated into their ERP systems, particularly for sensitive financial data and supply chain management.

Zero Trust Architecture

The traditional perimeter-based security model is no longer sufficient in the age of cloud-based ERP systems and remote work. Zero Trust Architecture (ZTA) is gaining traction as a more robust approach. This model operates on the principle of "never trust, always verify," requiring authentication and authorisation for every user and device attempting to access resources in the ERP system, regardless of their location. Implementing a Zero Trust model can significantly enhance the security posture of your ERP system.

Continuous Compliance Monitoring

With the pace of regulatory change accelerating, annual audits are no longer sufficient to ensure compliance. Modern ERP systems are incorporating continuous compliance monitoring tools that can track regulatory requirements in real-time and alert stakeholders to potential compliance issues as they arise. This proactive approach can significantly reduce compliance risks and costs, allowing CFOs to stay ahead of regulatory challenges.

Strategies for CFOs

Cultivating a Security-First Culture

As CFOs, we play a crucial role in setting the tone for the entire organisation when it comes to security and compliance. Cultivating a security-first culture is essential. This means not only investing in technology but also in training and awareness programmes that empower every employee to be a front-line defender against security threats. Regular security briefings, simulated phishing exercises, and clear security policies can all contribute to a more resilient organisation.

Collaborative Governance

Effective security and compliance in modern ERP systems require collaboration across multiple departments. CFOs should champion a collaborative governance model that brings together finance, IT, legal, and operations teams. This cross-functional approach ensures that security and compliance considerations are integrated into every aspect of ERP strategy and operations, from system design to day-to-day use.

Risk Quantification and Investment Prioritisation

With limited resources, it's crucial to prioritise security and compliance investments effectively. Adopting a risk quantification approach can help CFOs make more informed decisions about where to allocate resources. By assigning monetary values to potential risks and the impact of security breaches, you can better justify investments in security and compliance measures to the board and other stakeholders.

Cybersecurity Insurance

As cyber threats continue to evolve, cybersecurity insurance is an increasingly important risk management tool. CFOs should evaluate cybersecurity insurance options as part of a comprehensive risk management strategy. These policies can provide financial protection in the event of a data breach or cyber attack, covering costs related to business interruption, legal fees, and reputational damage.

Regular Security Audits and Penetration Testing

Proactive security measures are crucial in protecting ERP systems. Regular security audits and penetration testing can help identify vulnerabilities before they can be exploited by malicious actors. As CFOs, we should advocate for and allocate resources to these critical activities, viewing them as investments in the organisation's long-term security and compliance posture.

The Road Ahead

Adapting to Evolving Threats and Regulations

The landscape of security threats and regulatory requirements is constantly changing. CFOs must foster a culture of continuous improvement and adaptability within their organisations. This means staying informed about emerging threats, regulatory changes, and technological advancements that could impact ERP security and compliance.

Leveraging Data for Strategic Decision-Making

While data proliferation presents security challenges, it also offers opportunities for more informed decision-making. CFOs should work closely with their IT teams to ensure that ERP systems are not just secure, but also capable of providing actionable insights. By leveraging data analytics capabilities within ERP systems, CFOs can gain deeper insights into financial performance, risk factors, and compliance status.

Balancing Security with Usability

As we implement more robust security measures, it's crucial to balance these with usability considerations. Overly cumbersome security protocols can lead to workarounds and shadow IT practices that ultimately undermine security efforts. CFOs should advocate for security solutions that enhance, rather than hinder, productivity and user experience.

Conclusion

The CFO role has expanded beyond traditional financial management. As custodians of some of the organisation's most sensitive data, we have a responsibility to lead the charge in protecting our ERP systems from security threats and ensuring compliance with an ever-growing list of regulations.

By embracing a proactive approach to security and compliance, fostering cross-functional collaboration, and leveraging emerging technologies and best practices, CFOs can transform challenges into opportunities. We can drive innovation, enhance operational efficiency, and build trust with stakeholders, all while safeguarding our organisation's most valuable assets.

The journey towards robust ERP security and compliance is ongoing, but with strategic vision and committed leadership, CFOs can navigate this complex landscape successfully. As we look to the future, one thing is clear. ERP systems, security and compliance are no longer IT issues and they demand our full attention, investment expertise, and leadership.

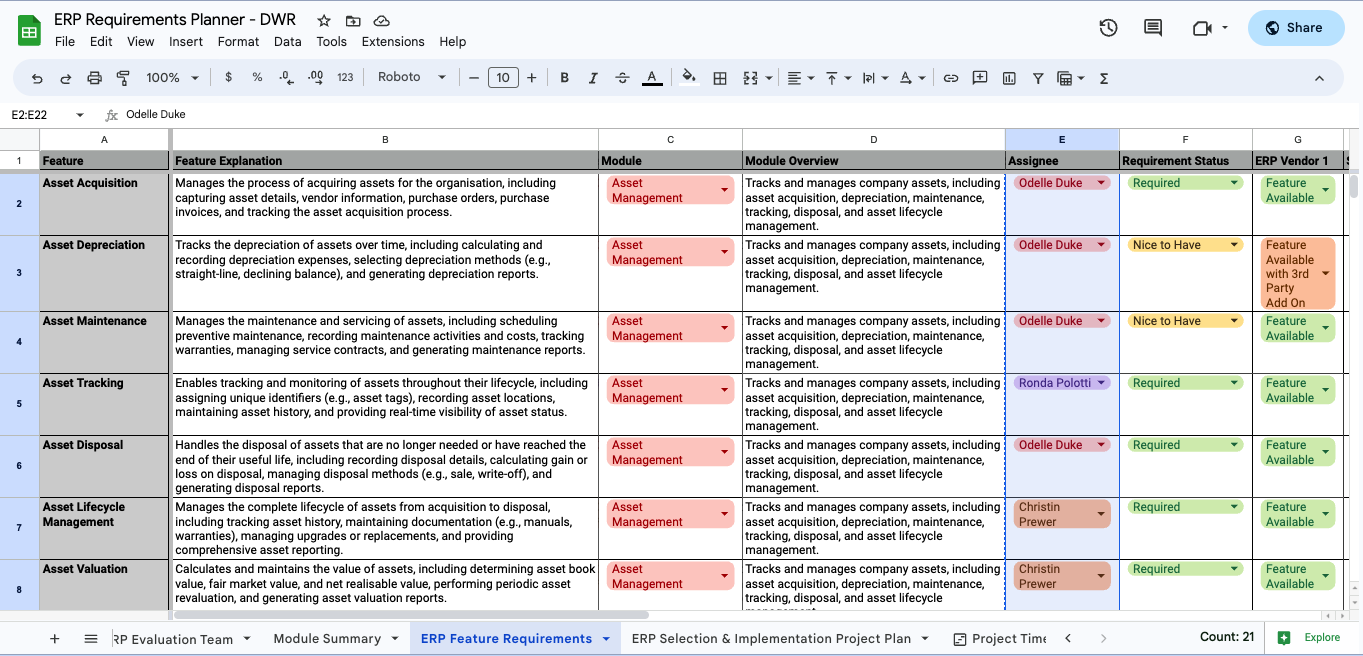

Not Sure If Your ERP System Is Secure?

DWR Consulting, a leading NetSuite partner, are teaming up with forward-thinking companies to ensure that they are building a software ecosystem that is ready for the new wave of cyber-security protocols.

If you are interested in understanding how your systems may be at risk, reach out to our team for an obligation-free assessment.

.svg)

.avif)